Tesla Loses Money on Every Car They Sell

October 1st, 2020No they don't.

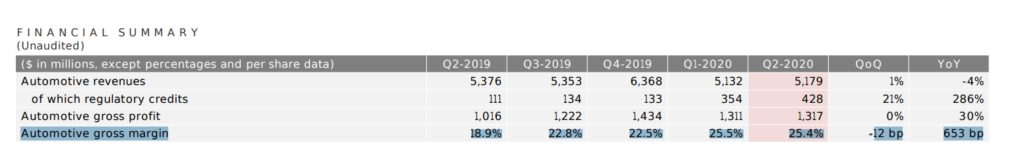

Where did this argument come from? Well, you have to look at the company's balance sheet. Then you have to explicitly ignore the line item "Automotive gross margin".

Gross margin is a company's net sales revenue minus its cost of goods sold (COGS). In other words, it is the sales revenue a company retains after incurring the direct costs associated with producing the goods it sells, and the services it provides.

With any sort of positive number here, you can't make the claim that Tesla's gross margins are negative. If you were able to say that Tesla's gross margins are negative, you could absolutely make the claim that Tesla loses money on every vehicle sold.

So how can anybody say Tesla loses money on every vehicle sold? Well there is another type of margin. Net Profit Margin.

The net profit margin is equal to how much net income or profit is generated as a percentage of revenue. Net profit margin is the ratio of net profits to revenues for a company or business segment. Net profit margin is typically expressed as a percentage but can also be represented in decimal form. The net profit margin illustrates how much of each dollar in revenue collected by a company translates into profit.

Does Tesla have negative net profit margins? Sometimes. But not in the last 4 quarters.

So anybody who says that Tesla loses money on every car is factually incorrect.

In order to stretch the truth to this, the argument is generally bundled with "If it wasn't for ..." Which basically means, I am going to subtract a big pile of money from Tesla to tip the scales in my argument's favour. That way, I can say what I want still.

So now the argument becomes, "If it wasn't for ZEV Credits, Tesla would lose money on every vehicles sold." Which really means, that if I can fuck with Tesla's balance sheet as I see fit, then I can make any case I want.

But why attack ZEV Credits? Well, ZEV Credits are a great target because if the balance of incentives were neutralized then that could feasibly happen.

But if we can just go ahead and make any argument, picking any line item off Tesla's balance sheet, neutralize it and make a claim based on that then I could also say. "If Tesla didn't deliver cars, then they would be losing money on every car produced."

See how stupid that sounds?

Back to ZEV Credits. These are credits from around the world. Multiple governments at the Federal, State/Provincial levels have created incentive plans. The underlying intention of these programs is to create fewer vehicles that pollute the air and more vehicles that do not. Eventually these ZEV Credits will be phased out. It won't be overnight. So claiming that this could be removed next quarter is a massive stretch.

It also ignores the case that ZEV credits still make good sense. Keep in mind, these credits exist at a time when Big Oil is at it's peak and well ingrained into politics. In Ontario for example, Doug Ford government broke the law when it scrapped cap-and-trade, court rules and Doug Ford government spent $231M to scrap green energy projects. Yet despite the $14K EV Incentive, a new EV incentive took it's place at the Federal level. EV incentives are quite resilient. And for good reason.

Consider how much it would cost to clean up the air in a way that undoes the vehicle emissions of a new I.C.E. vehicle? If you take that price, penalize the car companies that manufacture vehicles that amount, then give it to the people putting most effort into undoing that, things balance out.

But regardless, the amount of money Tesla spends is a good thing if maximized efficiently. Creating better processes to bring costs down. Building new factories, creating good paying jobs. Expanding their product line. Solving difficult problems.

If you recall, Tesla clearly has positive gross margin on vehicles. We have to lump all revenue expenses and strike line items off Tesla's balance sheet to make any case that Tesla loses money on vehicles. If it wasn't for ZEV credits, Tesla would have to cut costs in other areas to ensure profit. They would be building fewer Supercharging stations. Have less Service Centres and Technicians. Researching slower. Not building/expanding 5 factories simultaneously.

Cutting back on any of those by a couple hundred million dollars would bring positive cash flow back. So you can see, the goal with Tesla isn't to make money. It is to be slightly profitable and grow how much money is spent efficiently.

But wait a minute... if Tesla is spending money as fast as they can, then why the decline in Operating Expense?

By the time you figure out the answer, you will be a Tesla BULL!

Posted In:

ABOUT THE AUTHOR:Software Developer always striving to be better. Learn from others' mistakes, learn by doing, fail fast, maximize productivity, and really think hard about good defaults. Computer developers have the power to add an entire infinite dimension with a single Int (or maybe BigInt). The least we can do with that power is be creative.

The Limiting Factor

The Limiting Factor Whole Mars Catalog

Whole Mars Catalog