If I were the S&P 500

September 8th, 2020We see a lot of bull and bears discuss what is good and what is bad. The bull thesis being, Tesla will be included. The bear hope thesis that Tesla will be excluded.

But what about the S&P? What is good for the S&P?

As the S&P, I want to get Tesla for very low and have any rallies behind the stock occur after we have taken our full position.

As the S&P, I want Tesla to dilute as many shares as possible to lower the price and increase the share supply.

As the S&P, I don't want rallies to occur prior to us including the stock especially a massive hype-based rally just days and weeks prior to our entry into the stock.

As the S&P, I want the flexibility to buy on a weight we deem appropriate.

As the S&P, I want to buy a huge dip.

As the S&P, I don't care about current shareholders prior to entry.

As the S&P, I don't care about the index funds that follow my every move.

As the S&P, I would prefer to puppet the Tesla company around with regards to dilution until such time that I am 100% entered.

With all of the above, I feel like the S&P has asked Tesla for multiple $5B capital raises. My guess is 2-4.

I expect Rob Mauer's numbers to be inflated. And/or S&P to consider doing a planned staggered entry instead of all-at-once.

I am not certain if S&P cares about the indexes that follow it. If they don't, then they may as well enter 100% of their position prior to announcement and benefit from the run-up. If they do, then they would likely do 25% or 50% entry per quarter to minimize disruption.

As the S&P, I would want insider information with regards to when Tesla might do the $5B at market capital raise. But such knowledge would likely not be shared with me because Tesla doesn't want to get in trouble with the SEC.

As the S&P, it would be better if I am able to time my purchase of the shares around Tesla adding shares to the market.

As the S&P, I care about the price of Tesla, but it will only make up a couple % of my portfolio, so I only care about it about 2%.

As the S&P, I don't want to buy a stock that is about to tank. So I would need to be confident in including Tesla.

As the S&P, Tesla's production growth thus far and future plans for factories gives them credibility. I should expect growth in the future.

As the S&P, I can do my own press releases with regards to inclusion. If we release lists that do not contain TSLA, speculation may arise that TSLA will not be included and drive the price of the stock down.

It's only ~2% of the index. They have probably already started buying long ago. They probably haven't finished entering.

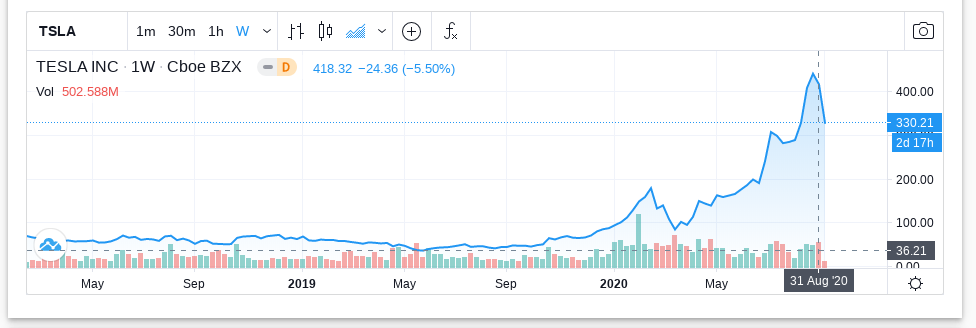

Assuming Rob Mauer is correct and that as the S&P I have to buy 117136339 shares of Tesla (117M shares).

Last week TSLA traded over 500M shares in volume. If in this process, they absorbed 25% of the stock in that time, than the S&P has absorbed the shares they need to.

The interesting part is what comes next. Has the S&P really aquired all the shares or do they need more? Will they announce inclusion? Did they release inclusion report in hopes to drive TSLA down with FUD?

As the S&P 500 I probably want to max my position before Battery Investor Day.

Posted In:

ABOUT THE AUTHOR:Software Developer always striving to be better. Learn from others' mistakes, learn by doing, fail fast, maximize productivity, and really think hard about good defaults. Computer developers have the power to add an entire infinite dimension with a single Int (or maybe BigInt). The least we can do with that power is be creative.

The Limiting Factor

The Limiting Factor Whole Mars Catalog

Whole Mars Catalog