Selling Naked $TSLA Puts

May 11th, 2022

Options are a complicated way of trading. With normal trading, you have to buy and sell. Options make this far more complicated by adding other variables such as expiry date and strike prices.

I won't go in-depth on options here, but I will explain what I am doing to sell a naked PUT.

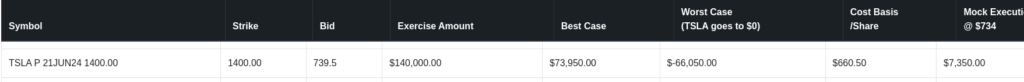

A PUT option is a right, but no obligation to force the contract seller to purchase shares of TSLA for a Strike price by some expiry date. The above example has a Strike of $1400 and an expiry of Jun 21, 2024.

By selling a PUT, I am giving the purchaser of the option the right, but not the obligation to force me to buy TSLA shares. What makes this a naked put option is that I am not short TSLA stock. So, therefore, I am forced to buy shares from the market (naked/uncovered) rather than transferring shorted shares (covered).

WRT the above example, the current stock price is $734 as labeled on the far right under Mock Execution. This is important to keep in mind because the price of the option is based on this.

The Strike price of $1400 is what I have to buy TSLA for.

The Bid is what I can sell the option for on the market.

The Exercise Amount is how much it will cost me to buy 100 shares (execute 1 option contract).

The best case for me is that the option contract expires worthless. If this happens, I pocket the entire contract cost amount for the 100 shares. 100 * Bid = $73,950 I give this low but not negligible likelihood.

My worst case is if I end up buying TSLA shares at $1400 and TSLA goes to $0. I give this a low % chance of happening. If it does happen, I still earn the cost of the contract and so (Bid * 100) - Exercise Amount = $73,950 - $140,000 = -$66,050 which softens the blow of buying a worthless stock for $1400/share.

So for selling 1 PUT, I could make $73,950, but I could also lose $66,050. There is a high likelihood that something will happen in between. The outcome and how well I do will be determined by how much the stock price is when my contract forces me to buy shares. If the price of the stock is greater than my Cost Basis/share, I make money. If the price of the stock is less than my Cost Basis/share, then I lose money.

So, to put all this into a nutshell sentence...

I am selling somebody the right, but not the obligation to force me to buy 100 TSLA shares. They will pay me $73,950 for this right. The stock will have to fall below $660.50 AND the purchaser of the option will have to execute the option when that is the case in order for me to lose money on this. If they do, I am forced to buy the shares at the $1400 price, but because they paid me $73,950 for this option contract, the 100 shares will cost me a net $66,050 giving me a cost basis of $660.50/share.

The 10% cheaper cost basis of the stock makes this investment less risky than just buying the 100 shares.

If the price of the stock doubles from $734 to $1438, I would still make about $500 more from selling the option.

If the stock price halves from $734 to $367, I would lose ~20% less

($367 - $660.50) * 100 = $29,350

as opposed to

($367 - $734) * 100 = $36,700

The only situation where it doesn't work out better for me is if the stock more than doubles. Which could happen, but buying call options would be the way to take advantage of that.

If you have any questions, hit me up @develevation on Twitter.

Posted In:

ABOUT THE AUTHOR:Software Developer always striving to be better. Learn from others' mistakes, learn by doing, fail fast, maximize productivity, and really think hard about good defaults. Computer developers have the power to add an entire infinite dimension with a single Int (or maybe BigInt). The least we can do with that power is be creative.

The Limiting Factor

The Limiting Factor Whole Mars Catalog

Whole Mars Catalog