TSLA Valuation

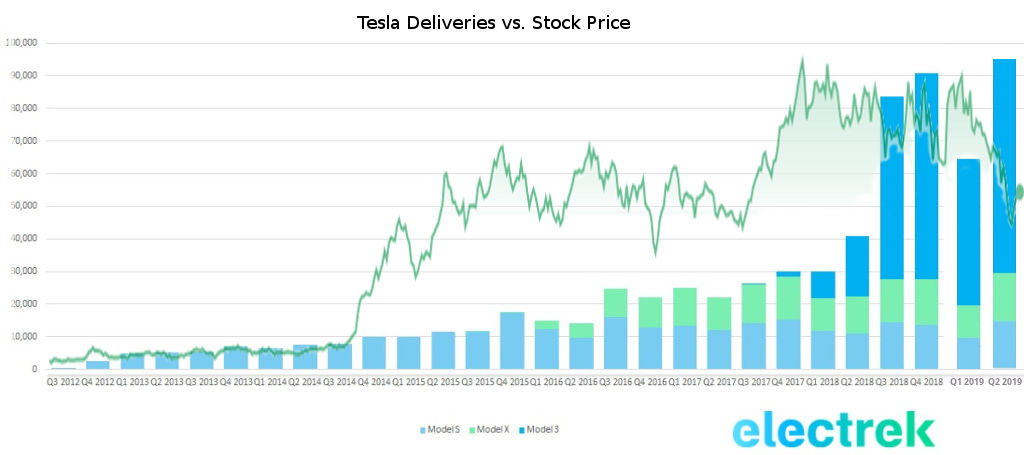

July 3rd, 2019Based on this post you can see there was a massive downturn for Tesla Q4 2018 which it almost recovers from before getting slammed again in Q1 2019.

What caused this? Was it justified? Should TSLA be at a new record high? If not, where should it be?

I think TSLA deserves a record high. Here is some more bull.

I guess the question is, did TSLA deserve the record high it had at any point in time? The graph clearly shows that TSLA stock rallied long before the Model 3 went into production. So let's look at where the stock price was at the Model 3 unveil? March 4 2016 the stock was at $200 and after the unveil a month later it was at $250 April 8. So $200 is the value of Tesla before ever talking publicly about the Model 3. $250 is the value of Tesla shortly after talking publicly about the Model 3. What is talk worth? I don't know. But apparently $50/share. And if you apply an additional $50/share for the Roadster and Semi, then you get pretty close to the TSLA high.

Are actions worth more than words? Definitely. What you say you are going to do does not matter if you do not do it.

After making the bold claims they did on March 31 2016, they actually delivered on what they said they would.

As the car went into production around Oct 2017, they had the goal to ramp up to 20,000 cars a month by end of Dec 2017. But they didn't achieve that and instead went into delivery hell. Six to eight months later they were able to achieve this.

The highest point TSLA reached was $371 in June 2018. Elon Musk did not tweet about taking the stock public until 7 Aug 2018. Had the price spiked to this level shortly after the $420 tweet, I would discount this high as artificial. But at the time, Tesla had promised to mass produce the Model 3 and it looked like they were succeeding with their ramp. So I would expect the value of Tesla at it's high would be based on production optimism and the up and coming cars.

So is $371 justified as a high? Well, it was based on promises to achieve 20,000 cars/month production. As well, the Solar Roof, the 2020 Roadster, and Semi. But not the pickup or the Y.

It also didn't factor in a Gigafactory in China.

So is there a balance with that? I think the addition of the new promises for Y production and the Shanghai GF make the stock even more valuable than it was at that time.

Tesla has now achieved over 30,000 cars delivered/month and are very close to achieving this in production.

This shows tremendous growth with Tesla in terms of delivery logistics. This growth makes the company more valuable.

Tesla also has more cash on hand with their capital raise. I cannot stress how valuable raising capital is. It literally adds billions of dollars of value to the company. With Tesla's market cap set at $42.22B the $1.5B raised + the up to $2B in environmental credits purchased by GM and FCA adds considerable value to the company. If TSLA were to post that combination as profit and broke even everywhere else, their multiple would be 10x this year.

They also acquired Maxwell Technologies. They unveiled their FSD strategy. Both of these make the company more valuable. Definitely more valuable than any other cars being manufactured without cameras.

They proved huge demand for EVs. This also adds tremendous value to the company as it accelerates them down the road of reduced cost which will be a competitive advantage.

So overall, I would say that Tesla has added value upon value upon value. Most factors never factored into the $371. I believe this price in no way incorporated the amount of money Tesla would make from green credits, GF China, Model Y, or Maxwell.

As for the Solar Roof, I don't think this is what was driving Tesla's stock up really high. If any mistakes were made by Tesla, arguably the acquisition of Solar City could be pointed to. But Tesla has also shown tremendous success on the Energy side proving their concepts and showing how economically viable their solutions are. I think this actually makes Tesla more valuable, but I am going to net it out as even and not focus too much on this side.

Factoring in all of Tesla's success, with their future promises of Model Y, Shanghai etc, $420 is too low a price target for a current valuation. I believe $600 is a much more reasonable current (today) value. And if Model Y, FSD, GF China work out 6 months late, this stock will go to upwards of $10,000/share in 5 years.

Posted In:

ABOUT THE AUTHOR:Software Developer always striving to be better. Learn from others' mistakes, learn by doing, fail fast, maximize productivity, and really think hard about good defaults. Computer developers have the power to add an entire infinite dimension with a single Int (or maybe BigInt). The least we can do with that power is be creative.

The Limiting Factor

The Limiting Factor Whole Mars Catalog

Whole Mars Catalog